In the world of medical billing, understanding key metrics is crucial. One such metric is the PC ratio. But what exactly is the PC ratio in medical billing?

The PC ratio, or Patient Collection ratio, measures how effectively payments are collected from patients. It's a vital indicator of financial health for healthcare providers.

A higher PC ratio signifies efficient billing processes and a healthy cash flow. This metric plays a significant role in revenue cycle management.

By monitoring the PC ratio, healthcare facilities can identify areas for improvement. This leads to better financial outcomes and patient satisfaction.

In this article, we'll explore the PC ratio's importance and how it impacts revenue cycle management.

Understanding the PC Ratio in Medical Billing

The PC ratio stands for Patient Collection ratio. It is a metric used to measure the efficiency of collecting payments from patients. In medical billing, this is crucial for assessing the financial health of healthcare organizations.

To understand it better, consider the following list of key aspects:

- Measures efficiency of payment collection

- Vital for revenue cycle assessment

- Influences financial health

A higher PC ratio indicates successful collection processes. It implies that a larger portion of billed charges is being received from patients. This is essential for maintaining a steady cash flow.

The PC ratio is calculated by dividing total patient payments by total billed charges. A ratio of 1 or above is generally regarded as effective, meaning full collection of billed charges.

Monitoring the PC ratio helps healthcare providers pinpoint inefficiencies in billing. It also enables them to devise strategies for improvement. By understanding this metric, healthcare administrators can enhance overall revenue management. This, in turn, supports the financial sustainability of healthcare facilities.

Why the PC Ratio Matters in Revenue Cycle Management

In revenue cycle management, the PC ratio is more than just a metric. It is a vital Key Performance Indicator (KPI) that helps gauge billing efficiency. Knowing how well the billing department collects payments impacts the organization's bottom line.

A robust PC ratio can lead to better financial outcomes. It reflects effective billing and collection processes. When consistently high, it suggests that patients are generally paying what they owe, which is crucial for financial health.

Healthcare providers can use the PC ratio to identify trends. This insight allows for timely interventions when issues arise. It also aids in resource allocation, ensuring that focus remains on areas needing improvement.

Factors influencing the PC ratio include patient demographics and insurance practices. Understanding these factors helps in formulating strategies to enhance collection efforts. Hence, the PC ratio can be pivotal in:

- Optimizing Revenue

- Reducing Bad Debt

- Ensuring Financial Visibility

By continually monitoring it, organizations make data-driven decisions, ultimately ensuring sustainable revenue cycle management.

How to Calculate the PC Ratio: Formula and Example

Calculating the PC ratio is straightforward yet crucial. It's determined by dividing total patient payments by total charges over a specific period. This provides a clear metric of collection efficiency.

A simple formula for calculating the PC ratio is:

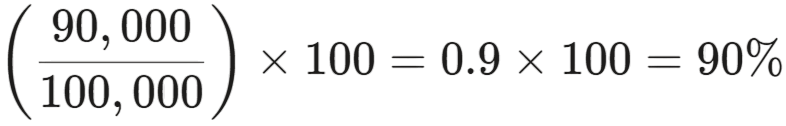

Let's consider an example to illustrate this. Suppose a healthcare clinic has total charges of $100,000 in a month. They manage to collect $90,000 from patients.

Using the formula, the PC ratio would be:

This ratio of 0.9 indicates that the clinic collected 90% of the billed charges. Generally, a ratio of 1 or higher signifies that the billing department collects the full amount billed.

A high PC ratio reflects a strong ability to collect payments due. Consistent calculation and monitoring provide valuable insights into billing efficacy. It's a crucial part of evaluating the overall financial performance in the healthcare sector.

PC Ratio vs. Other Key Billing Metrics

The PC ratio is only one of many essential metrics in medical billing. Understanding its context among others is necessary for comprehensive financial analysis.

Comparing it with other metrics aids in a deeper understanding of billing performance. For instance, while the PC ratio focuses on patient payments, the net collection rate considers payments from both patients and insurers.

Key billing metrics include:

- PC Ratio: Focuses on patient payment efficiency.

- Net Collection Rate: Measures overall payment efficiency including insurers.

- Days in Accounts Receivable (AR): Indicates the average time to collect payment post service.

The net collection rate, therefore, offers a broader view of revenue collection. Meanwhile, Days in AR provides insight into the speed of collections.

Each metric provides unique insights. Using them together strengthens financial planning and strategy development in healthcare settings. Balancing these metrics ensures a stable financial environment.

Factors That Influence the PC Ratio

Several factors can dramatically impact the PC ratio. Each plays a role in shaping how payments are collected in healthcare settings.

Patient demographics are a significant factor. Different populations have varying levels of insurance coverage. This influences their ability to pay directly.

Billing practices also matter greatly. Efficient processes help ensure prompt and complete collections. Ensuring accuracy in bills can reduce delays and disputes.

Influencing factors include:

- Patient Demographics: Age, income, and insurance status.

- Billing Practices: Accuracy and timeliness of bills.

- Economic Conditions: Impact patient capability to pay.

Economic conditions add another layer of complexity. Economic downturns can reduce patients' disposable income. This impacts their ability to fulfill financial obligations.

Understanding these factors is crucial for healthcare providers. A comprehensive view helps optimize strategies for improving the PC ratio. Balancing these elements can lead to better financial health overall.

Common Reasons for a Low PC Ratio

A low PC ratio can be troubling for healthcare organizations. It often signals underlying issues in the billing and collections process. Identifying these issues is the first step to resolution.

One common reason is inaccurate billing. Errors in charges or patient details can lead to disputes and delayed payments. Such inaccuracies are not only inconvenient but also financially detrimental.

Common causes for a low PC ratio:

- Inaccurate Billing: Errors lead to payment delays.

- Ineffective Communication: Patients unaware of payment obligations.

- Poor Denial Management: High rate of denied claims.

Additionally, ineffective communication with patients can contribute. If patients aren't clear about their payment responsibilities, delays can result. Lastly, poor denial management can leave claims unresolved. This causes a backlog and reduces the collection rate. Addressing these issues can significantly improve the PC ratio.

Strategies to Improve the PC Ratio

Enhancing the PC ratio is crucial for optimizing revenue cycle management. By employing targeted strategies, healthcare providers can achieve this goal.

The first step is streamlining billing processes. Using advanced billing software can reduce errors and improve accuracy. Automated systems ensure that billing is both timely and precise.

Steps to streamline billing:

- Implement Automated Billing Software: Minimizes human errors.

- Regular Training for Staff: Keeps billing teams updated.

Improving patient communication is also vital. Clear explanations of financial responsibilities can prevent confusion and encourage timely payments. Employ multiple communication channels to reach patients effectively.

Strategies for better patient communication:

- Offer Clear Payment Plans: Patients understand payment schedules.

- Use Multiple Channels: Emails, texts, and calls for reminders.

Effective denial management should not be overlooked. Analyzing denial trends and reasons helps address frequent issues. By resolving these promptly, healthcare providers can recover potential lost revenue.

Finally, continuous staff training plays a significant role. Well-trained staff can handle billing queries efficiently and reduce the chance of errors. Regular updates ensure staff are aware of the latest billing policies and technologies.

Real-World Examples: PC Ratio in Different Healthcare Settings

PC ratios vary across healthcare environments. Each setting presents unique challenges and opportunities.

For instance, in large hospitals, maintaining high PC ratios requires streamlined processes due to the sheer volume of patients. Clinics, on the other hand, might focus on personalized patient communication to boost collections.

Consider these examples:

- Large Hospitals: Use automated systems for efficiency.

- Private Clinics: Engage patients with personalized billing communication.

- Specialty Practices: Tailor strategies based on specific patient demographics.

In specialty practices, understanding patient demographics is crucial for optimizing the PC ratio. Different patient needs require tailored billing strategies to ensure full collections.

These real-world examples illustrate how tailored approaches can maximize the effectiveness of the PC ratio across varying healthcare settings. Adapting strategies to specific environments is key to improving financial outcomes.

Best Practices for Monitoring and Benchmarking the PC Ratio

Monitoring the PC ratio is a continuous process. It helps to pinpoint inefficiencies and optimize collections.

Regular tracking ensures early detection of issues. Staying proactive prevents revenue cycle disruptions.

Consider these best practices:

- Regular Review: Analyze PC ratios monthly.

- Benchmarking: Compare against industry standards.

- Audit Procedures: Conduct periodic audits to ensure accuracy.

Benchmarking is critical. It identifies performance gaps by comparing PC ratios with industry standards. This approach highlights areas needing improvement.

Audits provide additional insights. They help verify the accuracy of calculations and identify revenue leakage, ensuring the financial health of healthcare organizations.

Frequently Asked Questions about PC Ratio in Medical Billing

The PC ratio often raises several questions. Understanding it can boost billing efficiency and optimize revenue.

Here are some common questions:

What is the PC ratio's role in revenue cycle management?

It's a key metric for evaluating collection effectiveness.

How does one improve a low PC ratio?

Focus on streamlining billing and enhancing patient communication.

These questions highlight the PC ratio's importance and offer insights into improving healthcare finances.

Conclusion: The Role of PC Ratio in Financial Success

The PC ratio is an essential gauge for financial health in medical billing. It ensures effective payment collections, directly affecting cash flow. By focusing on improving this metric, healthcare providers can enhance financial stability and reduce bad debts.

Optimal PC ratio management requires constant monitoring and process adjustments. Doing so leads to improved billing practices and patient satisfaction. Understanding this vital metric in revenue cycle management can be the cornerstone for sustained financial success in healthcare organizations.